Bad credit can be an expensive problem to have to live with, but it doesn’t have to be impossible to repair it. If you put in the time and research needed, there are several ways that you can repair bad credit yourself without having to pay any outside company to do so on your behalf. Take a look at these tips on how you can repair bad credit yourself and see just how much you can do by yourself to fix this problem once and for all!

1.Get A Copy of Your Credit Report

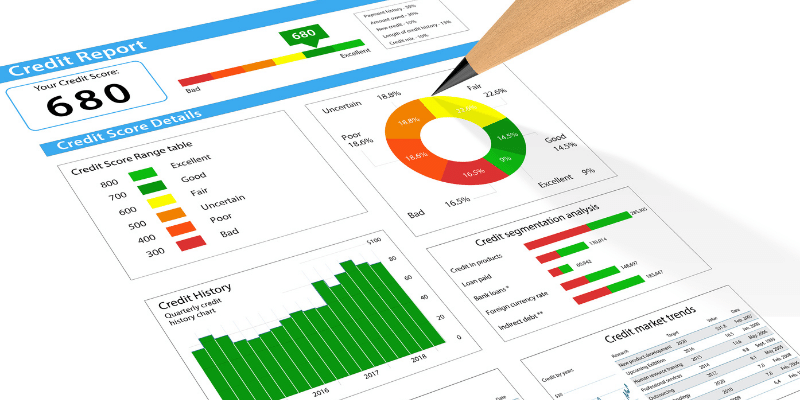

You need to get a copy of your credit report and then find out what factors are hurting your score. This could be overdue payments, high balances, or too many inquiries. Once you know the factors affecting your score, work on eliminating them one by one. For example, if a high balance is hurting your score, you might want to pay down that balance as much as possible. If an inquiry is hurting your score, try to limit the number of new ones for it to start to improve over time.

2. Identify the Negative Items on Your Report

It’s no secret that bad credit can make it difficult to get approved for loans, a car lease, or even a cellular phone contract. However, there are some steps you can take to fix your bad credit. Start by understanding the items that are impacting your report. The three most common factors in determining if someone will be offered a loan are:

- Age of the accounts

- Amount of available credit

- Type of account. If you're over many years old and have an excellent payment history and low debt-to-credit ratio, but have had a few late payments in the past couple of years due to job loss or other circumstances beyond your control, focus on correcting those items first before any others

3. Dispute the Negative Items with the Credit Bureau

Disputing negative items with the credit bureau is an effective way to fix bad credit. Since your creditor likely reported these items to the bureau, they will send a letter to the company, which then has thirty days to respond. If the company doesn’t respond, the negative item will be deleted from your report.

If they do dispute it, they’ll send a copy of your dispute and request for evidence of verification document to the reporting agency. The creditor has fifteen days to send their response back and either verify or update/remove the disputed information.

4. Create a Budget and Stick to It

It is important to create a budget and stick to it. By creating a monthly budget, you will know exactly what your expenses are and what your income is. This will also help reduce your bad credit because by sticking to this budget, you will be able to avoid getting into any more debt. The key is for the person with bad credit repair to realize the importance of sticking with the budget. Once they do that, they may not need bad credit repairs. There are bad credit repair companies that offer services to people who have bad credit to help them improve their finances. Some of these companies offer assistance with paying bills, finding cheaper interest rates on loans, or making late payments to help restore one’s good credit rating. However, there is no easy way out when it comes to bad credit; the person must be willing to change their spending habits and take charge of their money if they want to turn around their financial situation.

5. Check for errors on Your Credit Report

Go to Annual Credit Report and order a report from all the bureaus. Fill out the form, check the box that says I agree to receive alerts about my credit and click Continue. Review your report for any errors or discrepancies. If you find an error or discrepancy, contact the creditor or lender and ask them to remove it from your record. If they refuse, dispute the item with the credit bureau. Pay off any delinquent accounts: Find out which debt is causing you problems and pay it off as soon as possible.